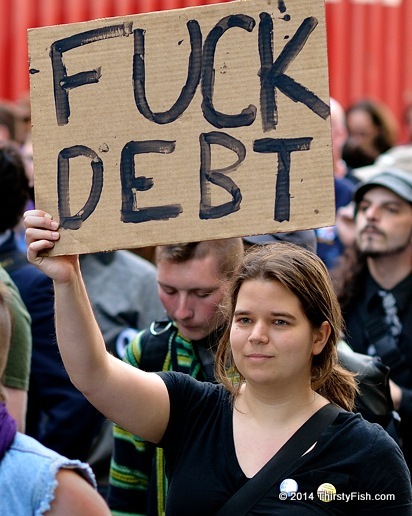

Occupy May Day 2013: Fuck Debt!

The Congressional Budget Office is estimating that the U.S. Department of Education is to make $127 billion in profits from college student loans in the next decade. Since the 1980's, educational institutions and lenders have been in collusion, raising tuition beyond affordable levels. Since 1980, tuition has gone up 600%, while real household income has stayed stagnant for pretty much most of us. What's more, college education does not pay anymore: Today, eight in ten young retail workers have bachelor's degrees and more than 33,600 PhD's are on food stamps.

The Federal Reserve recently announced that student loan debt totals almost $1 trillion, twice what it was in 2007. It exceeds auto loan debt of $783 billion, and total credit card debt of $679 billion. In 1980, total household debt was about 40% of GDP, whereas today, it is over 90% of GDP, and many of us are becoming the working poor. Many snobs argue that debt is indicative of "living beyond one's means", but such analyses are misleading. While most of our wages have been stagnant despite higher work productivity, bankers have devised "innovative" ways like credit card billing tricks, fake housing bubbles and tuition hikes to ensure that we live as Debt Slaves. Fuck Debt!

The system is being increasingly rigged against the natural person, making debt and debt slavery harder to combat. There are ways to fight it; The Indignados Movement in Spain has some ideas.

Posted

- Wed 2014-04-16

Captured

- 2013-05-01

- New York, NY